How To Build A Self-Funding Income System Potentially By Age 55 & Stay In Control Of Your Cashflow For Life

Without Juggling Scattered Accounts, Wasting Hours On Research, Or Risking Hard-Earned Capital On Guesswork.

A private consultation to structure your finances into a coordinated, self-funding income plan.

Staying On Track With Your Retirement Timeline Is Harder Than Ever

Life Moves Fast, Markets Move Even Faster.Between project deadlines,

family responsibilities,

and evolving markets,

finding time to stay financially on track isn’t easy.

Even with consistent saving and sound decisions,

portfolios may drift, scattered across multiple platforms and products that are tough to manage effectively.

What if your portfolio could operate in coordination to evolve into a self-funding system when you need it most?

Mission

Arron is on a personal mission to design the best accumulation and income plans that complements your existing portfolio(s).Through a logic-driven framework BIS — Build, Integrate, Sustain to help you design coordinated structure that:1. Grows efficiently today

2. Transitions smoothly into income later

3. Remains stable for life.Every Dollar, Account, and Decision works in sequence toward lasting income stability.

The BIS Framework

BUILD your accumulation plan to outpace inflation and compound steadily, balancing growth with control.INTEGRATE overlooked and underutilised assets into one coordinated system — so nothing sits idle, and every decision works efficiently towards your future income flow.SUSTAIN structured growth today with flexibility for income later. Your plan evolves with changing markets and life stages, staying aligned to your goals.

Why Work With Arron?

Experienced with Analytical Professionals

Trained in systems thinking and seasoned in tech operations, Arron brings a structured, analytical approach to money. This makes him a trusted advisor for professionals who value precision and logic in their financial decisions.

Specialised in Coordinated Portfolio Design

Arron structures your finances like connected systems, where each component functions as part of a unified design to keep progress moving efficiently toward defined goals.

Compare Best-in-Class Investment Platforms

Through IPP Financial Advisers’ open-architecture platform, Arron and his team have access to over 90 global fund managers and 10 life insurers. This gives clients freedom of choice and the confidence that every recommendation is selected for structure, suitability, and lasting performance.

Some Of Our Fund Managers & Platform Partners

Industry Awards

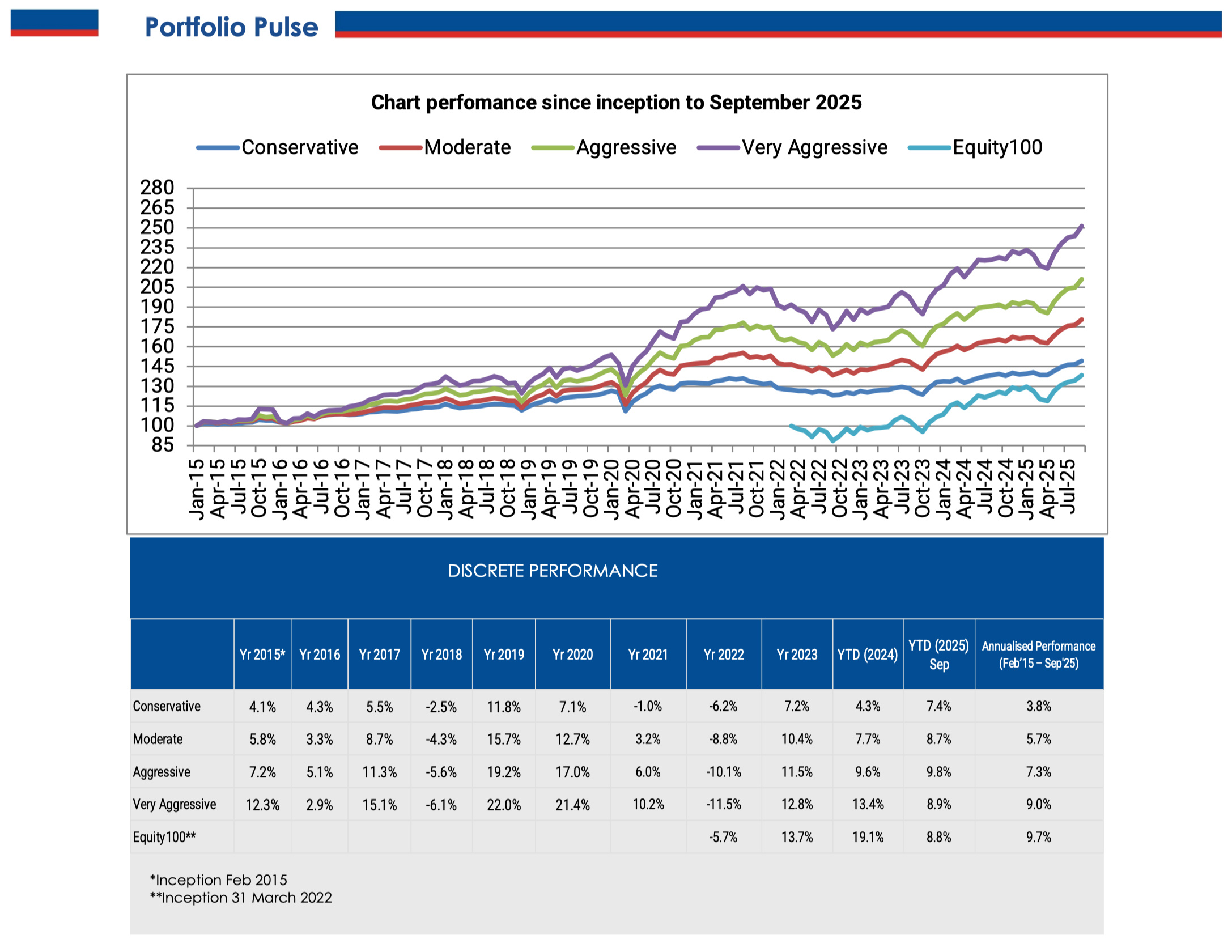

Performance Highlights

(10 Years Track Record)

IPPFA Eagle Eye’s Proprietary Portfolio

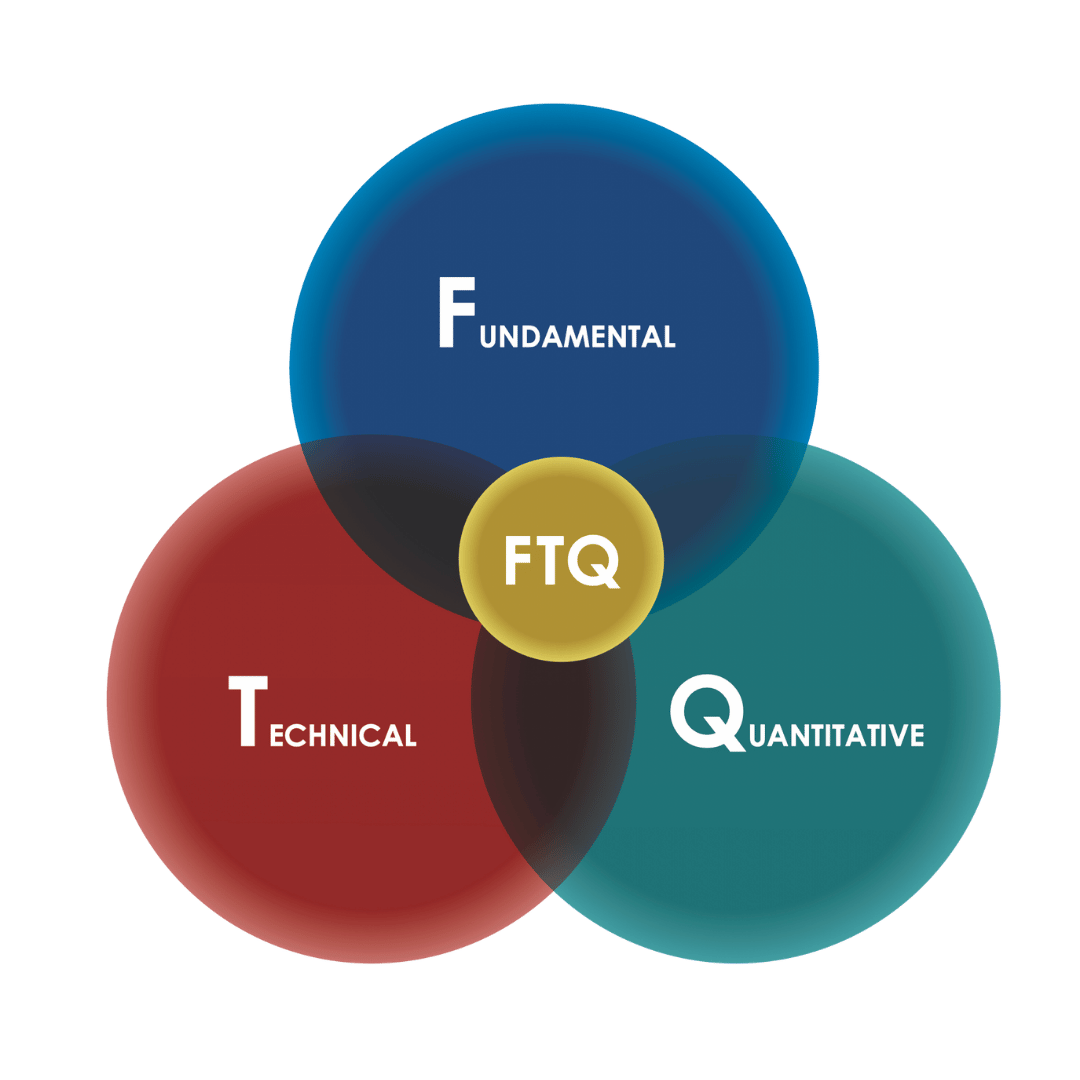

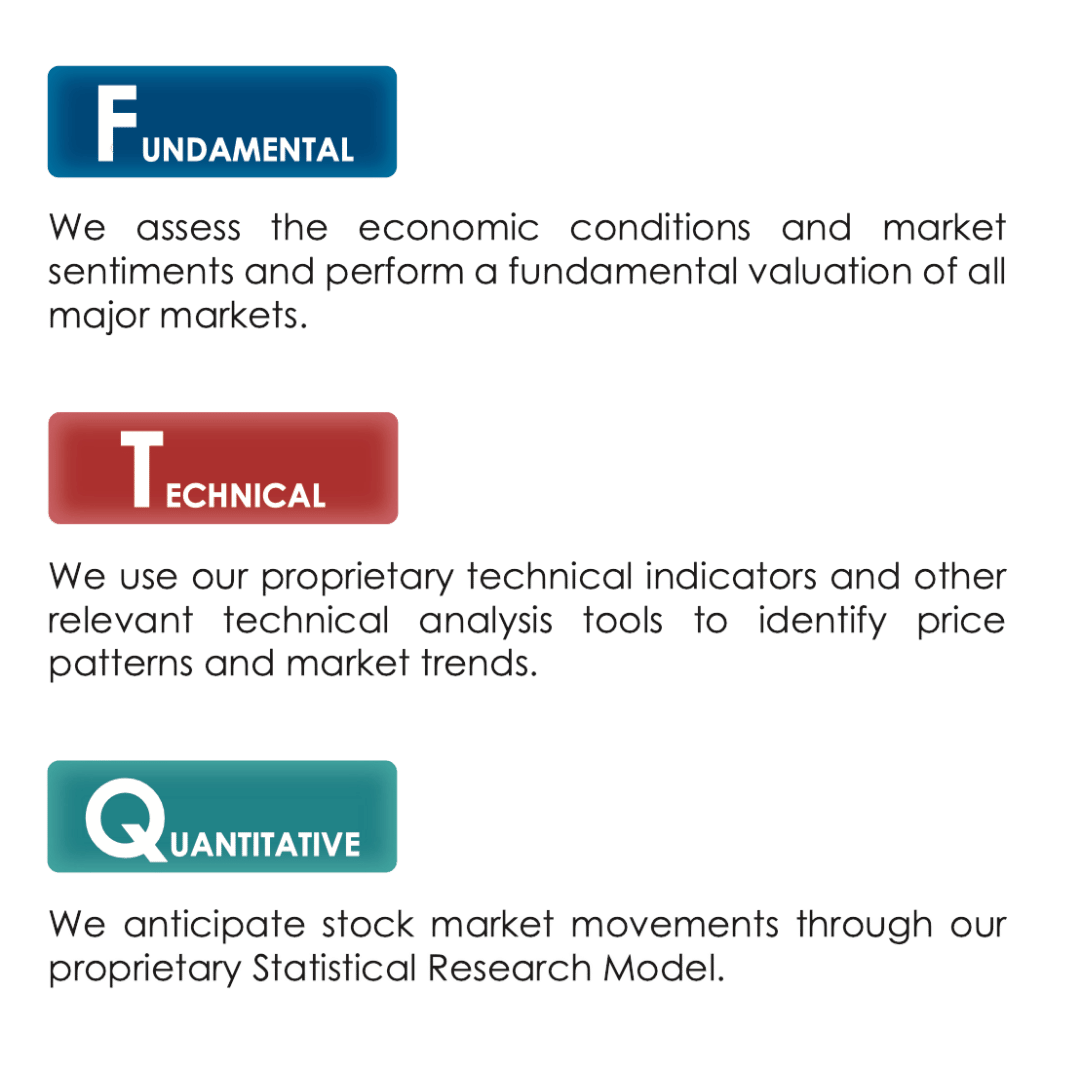

Investment Methodology

BUILD A COORDINATED FINANCIAL SYSTEM THAT WORKS

It’s clear why many analytical professionals turn to Arron when they want logic, clarity, and control in their finances.Simply fill out the application form below to request for a complimentary 30-min discussion & Arron & his team will get back to you.Here’s what you’ll gain from this sharing session:

STRUCTURED WEALTH ACCUMULATION PLANNING☑️ Identify and align existing assets — Cash, CPF, SRS, and investments — into a coordinated system that grows efficiently.

☑️ Assess capital allocation efficiency to reduce drag and improve long-term compounding results.

☑️ Optimise accumulation strategies using structured diversification and disciplined reviews.

☑️ Receive a clear, data-driven projection of how your capital evolves toward future income readiness.

COORDINATED INCOME GENERATION PLANNING☑️ Determine your sustainable income range based on current assets, yield potential, and liquidity needs.

☑️ Compare dividend-based and growth-based income solutions across leading fund managers and insurers under IPP’s open-architecture platform.

☑️ Build an adaptive plan that transitions from growth to income smoothly — balancing consistency, flexibility, and control.

☑️ Receive a clear blueprint showing how your financial system sustains itself over time.

See How Your Finances Can Work in Coordination

By submitting this form, I authorize, agree and consent to be contacted for retirement planning in accordance with the Personal Data Protection Act 2012 and our data protection policy. I am aware that I may withdraw my consent provided by me any time by submitting my request to [email protected].

Arron Oh and Retirement Blueprint is a group of Financial Adviser Representatives of IPP Financial AdvisersThis advertisement has not been reviewed by the Monetary Authority of Singapore.

Terms & Conditions

• The product mentioned in this advertisement is a Managed Portfolio of Unit Trusts. Eagle Eye is the model portfolio of unit trusts/mutual funds. It started formally in Feb 2015, and it is managed by IPPFA’s Investment team. The composition of the portfolio reflects the investment views and strategy of the Investment team, with the consensus of the Investment Committee. Eagle Eye model portfolio follows a fund-of-funds concept, where the underlying consists of mutual funds. The mutual funds are registered with the Monetary Authority of Singapore.• Investments involve risk and you may lose the principal amount invested. Returns are not guaranteed. Past performance is not necessarily indicative of future performance.• Portfolio Performance data for IPPFA Eagle Eye’s proprietary portfolio is based on the performance (as at 2025-03-31) since inception (Feb 2015). You may find the performance by calendar year and annualized performance below.• This is for your information only and does not consider your specific investment objectives, financial situation or needs. It is not a contract of insurance and is not intended as an offer or recommendation to purchase the plan. All investment applications are subject to Service Provider's approval.• The rate of return stated is before deducting fees and charges which might be applicable, including initial sales charge, wrap fees and platform fees. Please seek advice from a Financial Adviser Representative before making any investment decisions.*Automatic rebalancing applies to IPP’s Discretionary Portfolio Management Service (DPMS) — so you don’t need to approve each portfolio change. Our investment team monitors and rebalances for you, both quarterly and as markets shift, keeping your strategy aligned without the paperwork.Reference number: [R142-25]

Privacy Policy for Retirement Blueprint

At Retirement Blueprint, accessible from https://retirementblueprint.sg, one of our main priorities is the privacy of our visitors. This Privacy Policy document contains types of information that is collected and recorded by Retirement Blueprint and how we use it.If you have additional questions or require more information about our Privacy Policy, do not hesitate to contact us.Information We CollectThe personal information that you are asked to provide, and the reasons why you are asked to provide it, will be made clear to you at the point we ask you to provide your personal information.How We Use Your InformationWe use the information we collect in various ways, including to:Understand and analyze how you use our website

Communicate with you, either directly or through one of our partners, including for customer service, to provide you with updates and other information relating to the website, and for marketing and promotional purposes

Log FilesRetirement Blueprint follows a standard procedure of using log files. These files log visitors when they visit websites. All hosting companies do this and a part of hosting services' analytics. The information collected by log files include internet protocol (IP) addresses, browser type, Internet Service Provider (ISP), date and time stamp, referring/exit pages, and possibly the number of clicks. These are not linked to any information that is personally identifiable. The purpose of the information is for analyzing trends, administering the site, tracking users' movement on the website, and gathering demographic information. Our Privacy Policy was created with the help of the Privacy Policy Generator.Cookies and Web BeaconsLike any other website, Retirement Blueprint uses "cookies". These cookies are used to store information including visitors' preferences, and the pages on the website that the visitor accessed or visited. The information is used to optimize the users' experience by customizing our web page content based on visitors' browser type and/or other information.Google DoubleClick DART CookieGoogle is one of a third-party vendor on our site. It also uses cookies, known as DART cookies, to serve ads to our site visitors based upon their visit to https://retirementadvisor.sgand other sites on the internet. However, visitors may choose to decline the use of DART cookies by visiting the Google ad and content network Privacy Policy at the following URL – https://policies.google.com/technologies/adsPrivacy PoliciesThird-party ad servers or ad networks uses technologies like cookies, JavaScript or Web Beacons that are used in their respective advertisements and links that appear on Retirement Blueprint, which are sent directly to users' browser. They automatically receive your IP address when this occurs. These technologies are used to measure the effectiveness of their advertising campaigns and/or to personalize the advertising content that you see on websites that you visit.Note that Retirement Blueprint has no access to or control over these cookies that are used by third-party advertisers.Third Party Privacy PoliciesRetirement Blueprint's Privacy Policy does not apply to other advertisers or websites. Thus, we are advising you to consult the respective Privacy Policies of these third-party ad servers for more detailed information. It may include their practices and instructions about how to opt-out of certain options.You can choose to disable cookies through your individual browser options. To know more detailed information about cookie management with specific web browsers, it can be found at the browsers' respective websites. What Are Cookies?Children's InformationAnother part of our priority is adding protection for children while using the internet. We encourage parents and guardians to observe, participate in, and/or monitor and guide their online activity.Retirement Blueprint does not knowingly collect any Personal Identifiable Information from children under the age of 13. If you think that your child provided this kind of information on our website, we strongly encourage you to contact us immediately and we will do our best efforts to promptly remove such information from our records.Online Privacy Policy OnlyThis Privacy Policy applies only to our online activities and is valid for visitors to our website with regards to the information that they shared and/or collect in Retirement Blueprint. This policy is not applicable to any information collected offline or via channels other than this website.Contact InformationIf you have any questions or concerns relating to IPPFA’s policies relating to the Personal Data Protection Act of Singapore, please contact us via the following email: [email protected]ConsentBy using our website, you hereby consent to our Privacy Policy and agree to its Terms and Conditions.

You’ve Taken the First Step Towards a More Structured Retirement.

I’ll be reaching out personally within 1–2 business days to schedule your Retirement Blueprint Consultation.This is a data-driven, structured session designed to help you:Identify if your current plan is still aligned with where growth, income and life are heading next.

Assess your CPF, cash, and investments through a coordinated retirement framework.

Map out a clearer, more predictable path forward — one that balances growth, liquidity, and income stability.

Thank you for trusting Retirement Blueprint.

We’ll speak soon to design a retirement plan that performs by logic, not luck.